texas estate tax rate

The average home price in this city is painfully high as well as its extremely high tax rate which is 221. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Tarrant County Tx Property Tax Calculator Smartasset

In past years the highest estate and gift tax rate has been 40.

. AUSTIN Texas Senator Paul Bettencourt R. You can look up your recent. 255 rows To find detailed property tax statistics for any county in Texas click the countys name in the data table above.

Questions about the citys property tax rate may be directed to the NRH Budget Department at 817-427-6053 or by email. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal. 1 day agoOn Tuesday commissioners approved Parkland Hospitals tax rate and budget next year of 02358 allowing Parkland to collect about 848 from the average-valued 360000.

Texas has no state property tax. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and. Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell County.

Local governments set tax rates and collect property taxes that they use to provide local services including schools streets roads police fire protection and. Tax Ratification Elections TREs if passed by voters will wipeout state mandated MO property tax relief Texas Insider Report. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax. Contact the district representative at 512-970-1909 for additional boundary information. This means the most an estate will be taxed is at 40 of the estates total value.

See what makes us different. The average effective property tax rate in the Lone Star State is 169 well above the national average of. The citys property tax rate will be 38 cents per 100 valuation 18 lower than the current rate of 0386965.

We dont make judgments or prescribe specific policies. The median property tax in Texas is 227500 per year based on a median home value of 12580000 and a median effective property tax rate of 181. Highest Average Annual Property Tax.

California has the highest. The exact property tax levied depends on the county in Texas the property is located in. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. Texas has some of the highest property taxes in the US. During the last three years the city has reduced its property tax rate.

For information about your property value please. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. All property not exempted has to be taxed equally and consistently at present-day market worth.

This data is based on a 5-year study of median property tax. The state sales tax rate in Texas is 625 percent. The Tyler County Emergency.

Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. For more details about the property tax rates in. A citys property tax provisions must conform with Texas constitutional rules and regulations.

The Comptrollers office does not collect property tax or set tax rates. Thats up to local taxing units which use tax revenue to. 2 days agoThe board is proposing a tax rate of 208956 cents per 100 valuation for the 2022-23 fiscal year a reduction of almost 27 cents or 114 from the current tax rate.

Texas has no state property tax. Overview of Texas Taxes. This rate has not changed in.

Tyler County Emergency Services District No. Monday thru Thursday closed Fridays Tax Rate Information - Access the Truth in Taxation Summary for. King County collects the highest property tax in Texas levying an average of 506600 156 of.

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

State Corporate Income Tax Rates And Brackets Tax Foundation

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

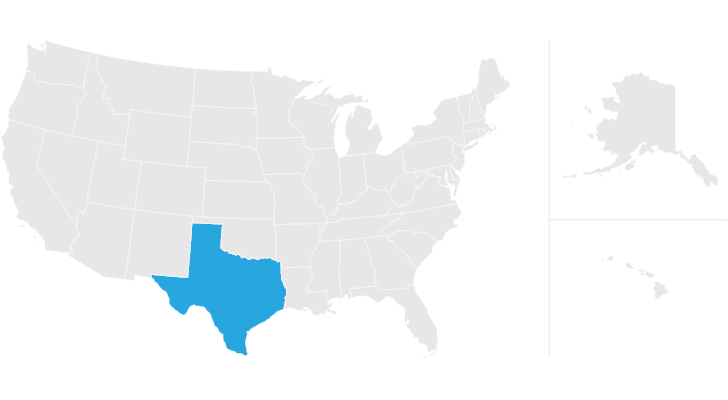

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Income Tax Calculator Smartasset

State Alcohol Excise Tax Rates Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales And Use Tax Rates Houston Org

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation